Leverages Silo Capital to strike the perfect balance of stability and growth, all while maintaining their culture-forward values.

Case Study

IMOK Global Partners with Silo

“In this industry you need a combination of strategy, integrity, and a steady stream of working capital to build a business the right way. Silo makes all three of these possible.”

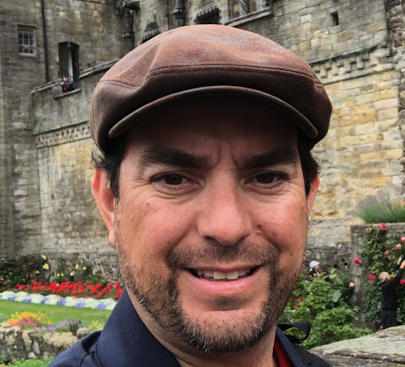

Hector Jimenez

CEO at IMOK Global

Featured Products

Let's get to know

IMOK Global

IMOK Global LLC prides themselves on providing the freshest, 100 Primus Lab-certified strawberries and blueberries to their American marketplace, harvested from the nutrient-rich California, USA and Zamora, Mexico regions. Hector Jimenez, owner and CEO of IMOK Global, has worked hard to build a forward-thinking company that could be a part of the change he wished to see in the produce industry. Composed of a team of mostly women and situated across three countries, IMOK Global prioritizes strong company values and delivers premium berry products with top-shelf customer service.

Location

San Francisco Bay Area, California

Team Size

10

Their Goals

As IMOK Global continues to deliver strawberries 365 days out of the year, their focus is to continue achieving cash flow stability and financial growth, in tandem with preserving their core company values.

Special ingredient to share

Strawberry Angel Food Cake

A light and refreshing summer time favorite, great for barbeques, birthdays, or your next family-night-in.

Ingredients

1 (10 inch) angel food cake

2 (8 ounce) packages cream cheese, softened

1 cup white sugar

1 (8 ounce) container frozen whipped topping, thawed

1 quart fresh strawberries, sliced

1 (18 ounce) jar strawberry glaze

Step 1

Crumble or cut cake into bite-sized pieces. Place in a 9x13-inch dish.

Step 2

Beat cream cheese and sugar in a medium bowl until light and fluffy.

Step 3

Fold in whipped topping. Press cake down to form a layer; spread cream cheese mixture over cake.

Step 4

Combine strawberries and glaze in a bowl until strawberries are evenly coated. Spread over the cream cheese layer. Chill until serving.

A culture-forward brand gets the traction they need to expand

The Challenge

To grow a produce business the right way, you need hard work and access to a steady flow of working capital. Hector Jimenez, founder and CEO of IMOK Global, knew this. Like many other wholesale distributors that work diligently to grow their business, Hector had grown tired of the cash flow fluctuations that were brought on by disjointed customer payments and shifts in market demands. In search of stability, Hector sought out financing patterns. Banks were too slow and rigid to meet IMOK Global’s unique needs, and the expensive and harsh practices of traditional factoring companies were at odds with IMOK Global’s values. Still in need of financing, Hector searched for an alternative capital partner that would support his company’s goals rather than undermine them.

The Solution

Silo’s Instant Pay solution unlocked a steady flow of funds for IMOK Global, ensuring cash flow predictability. Unlike traditional factoring and other financial solutions that didn’t quite fit the unique needs of the produce industry, Silo’s human-focused approach to financial partnership gave IMOK Global the tools, confidence, and security they needed to succeed. As Hector grows IMOK Global to meet its fullest potential, he leverages Silo to invest more into his valued teams and execute on the strategic growth opportunities that level up his vision for a business built on integrity.

Applying Instant Pay to my business gave me incredible traction with my suppliers and customers. When you have financial security, you operate differently–more confidently. The difference is tangible.

The Results

Quadrupled sales volume on strawberries

Silo Instant Pay enabled them to purchase and move 4x the amount of their in-demand strawberry product.

200% increase in revenue in less than one year

With more cash upfront to purchase product, IMOK Global was able to secure new customers. Their sharp increase in sales brought in significant revenue increases.

Successful launch of Vesta brand

Silo Instant Pay supported the funds IMOK Global needed to launch their own label of strawberries, Vesta, into retail stores across Mexico and the US.

A company vision that would not be compromised

Hector Jimenez, founder and CEO of IMOK Global, knew what he wanted for his business and was unwilling to compromise his values to maintain it. His vision? To build a future-forward produce company that prioritizes employee development, attracts and elevates female leadership, produces products rooted in quality, and delivers a superior customer experience.

To build such a business would be a challenge, and would require steady access to working capital. “Culture and integrity is important. It’s not easy, but for me, it’s necessary. In this business you need strong cash flow and very deep pockets to do this successfully,” Hector remarked. But like many other small and medium sized wholesale distributors in the produce industry, IMOK Global’s cash flow fluctuations made it difficult to gain traction and keep operations moving forward, as planned.

Silo is there to give good businesses a chance to be great.

Unpredictable business cycles, untapped potential, and risky financial options.

Cash flow unpredictability, sharp demand fluctuations, and delayed customer payments were a constant inconvenience for IMOK Global. As a result, Hector too frequently found himself over-spending to quickly plug the cash flow gaps necessary to keep his valued suppliers happy and continue investing in his employees. Without a deep financial foundation, Hector felt blocked in his ability to provide lasting security for his team or scale IMOK Global’s operations, as planned.

Traditional banks did not factor in industry nuances into their underwriting process and thus made traditional borrowing too risky for IMOK Global. When Hector turned to alternative options, such as factoring, he quickly learned that these companies had practices that were at odds with his business model and values. Known to harass IMOK Global’s customers, Hector cut ties with these factoring companies before they could further damage the valuable relationships he had spent time building. “Typical industry factoring companies are just after everyone's money. It feels as if they have zero interest in developing a healthy collaborative relationship with the businesses they are supporting,” remarks Hector.

Concerned for the wellbeing of his team and the future of his business, Hector continued his search for a unique financing partner that would support his company’s goals rather than undermine them.

Financing creates stability. Once you have stability, you see the potential in your future.

Enter Silo – a flexible, industry-specific financing solution with a human touch

Unlike the other financing options Hector had explored, Silo used a unique underwriting process to formulate a win-win scenario for IMOK Global. Silo’s Instant Pay solution would deliver the meaningful relief Hector needed, without encroaching on their customer relationships.

IMOK Global implemented Instant Pay across their operations, quickly closing cash flow gaps that caused operational disruptions. Through Instant Pay, IMOK Global got immediate access to their AR funds and reinvested the working capital back into delivering more of their increasingly popular product to their expanding customer base. As demand grew, so did their ability to attain higher margins, to which they further invested in the infrastructure needed to support their growth.

Silo is consultative and is truly a partner because they care about finding the right solution for us. We walk Silo through IMOK Global’s challenges and our goals, and then Silo pitches us a set of solutions. Our business is a project we work on together.

Consultative approach to partnership with strong value alignment

To Hector, Silo’s hands-on, human approach to financing was an immediate breath of fresh air. Silo’s approach to financing meshed well with IMOK Global’s core values of connection, collaboration, and integrity. It was clear that the Silo team cared about the well-being and longevity of IMOK Global’s business as they spent time fully understanding their vision. It was through this that they were able to execute a financial strategy together.

Our growth continues to feel like a project we are working on together.

“Silo is consultative and shows up like a true financial partner. Finding the right solution for us was and is their priority. As I walked the Silo team through our challenges and goals, Silo pitched us a set of solutions. Our growth continues to feel like a project we are working on together.”

Hector attributes his collaborative partnership with Silo as a key factor in helping IMOK Global meet their full potential. “When I go into a room or enter negotiations, I know that Silo has my back. As we grow and invest in new relationships, I know that with Silo, I’ll be able to do so with my values intact. That brings me pride in what IMOK Global is delivering.”